DFS ordered Gemini to refund $1.1 billion to Earn users and pay a $37 million fine due to oversight lapses.

The New York State Department of Financial Services (DFS) has announced a landmark agreement with Gemini Trust Company, LLC, a leading cryptocurrency exchange and custodian. The enforcement action, led by Superintendent Adrienne A. Harris, requires Gemini to return no less than $1.1 billion to customers of its Earn program following its entanglement with the bankruptcy of Genesis Global Capital, LLC (GGC).

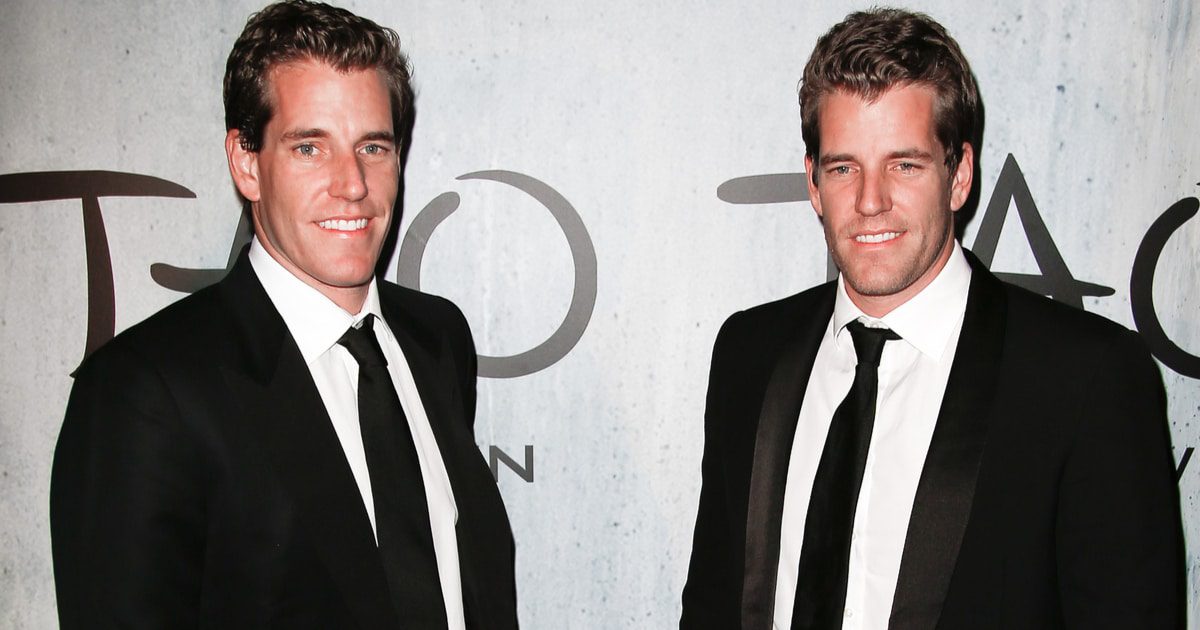

Gemini, co-founded by Cameron and Tyler Winklevoss, launched its Earn program on February 1, 2021, which allowed customers to lend their cryptocurrency to GGC in exchange for interest payments. However, the platform faced significant setbacks when GGC defaulted on about $1 billion in loans from Earn customers, leading to a suspension of withdrawals and subsequent bankruptcy.

Superintendent Harris highlighted Gemini’s lack of due diligence on GGC, an unregulated third party, which resulted in significant financial and reputational damage to over 200,000 Earn customers, including nearly 30,000 New York residents. The settlement appears not only as a measure to correct the harm done to these users, but also as a warning to the crypto industry about the importance of regulatory compliance and the protection of client assets.

As part of the settlement, Gemini will contribute $40 million to GGC’s bankruptcy estate, in coordination with the bankruptcy court, to facilitate the return of assets to Earn’s customers. In addition, Gemini will incur a $37 million penalty for a series of noncompliance that undermined the safety and reliability of its operations.

The DFS investigation revealed that Gemini’s Earn program was marred by inadequate oversight and reserve management. Additionally, Gemini Liquidity, LLC, an unregulated affiliate, was found to have siphoned off hundreds of millions in client fees that weakened Gemini’s financial condition. These revelations highlight the complex web of financial and regulatory challenges facing cryptocurrency entities, particularly when they intersect with traditional financial systems.

This development has ripple effects across the crypto landscape as it highlights the strict stance that regulators are taking on compliance and consumer protection. The agreement serves as a precedent for the level of scrutiny and accountability that crypto platforms are likely to face going forward.

DFS has reaffirmed its commitment to protecting the integrity of the financial market by ensuring that licensed entities such as Gemini operate within the bounds of government regulations and in the best interests of their clients. This case also illustrates the complexity associated with virtual currency businesses and the need for clear regulatory frameworks to govern their operations.

Gemini’s settlement is poised to restore user confidence in the platform, and by extension, the broader crypto market, by demonstrating that regulators are actively working to protect investors’ interests. Additionally, it may prompt other crypto entities to proactively strengthen their compliance measures to avoid similar punitive actions.

Image source: Shutterstock